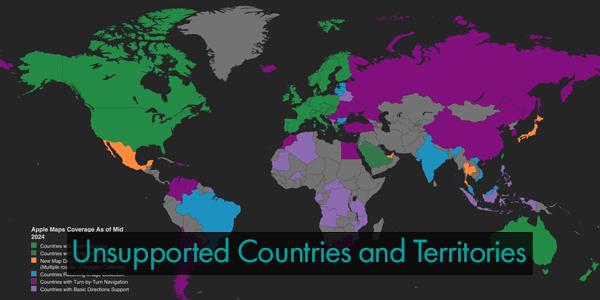

Unsupported Countries and Territories

At Yanance, our mission is to build a secure, accessible, and innovative platform for cryptocurrency trading — spanning spot, futures, binary options, and peer-to-peer (P2P) markets. To achieve this, we strictly adhere to international legal and regulatory standards. This unwavering commitment to compliance means we must, in some cases, limit or prohibit services in specific countries or regions.

We understand that global access is crucial in the digital economy, but it must be balanced with regulatory obligations and the protection of our users, partners, and financial systems worldwide.

🔎 Our Risk-Based Compliance Framework

Yanance adopts a risk-based compliance model that guides our decisions on where and how we operate. This framework is designed to ensure that all our activities align with the legal, financial, and operational expectations of each jurisdiction.

1. Regulatory Environment

Before offering services in any region, we conduct an extensive review of its legal and regulatory framework. Key considerations include:

-

Whether cryptocurrency exchanges are recognized or regulated.

-

Local licensing requirements for digital asset service providers.

-

Anti-Money Laundering (AML) and Know Your Customer (KYC) standards.

-

Data protection and consumer protection laws.

We refrain from operating in jurisdictions where regulatory clarity is lacking or where compliance would expose us or our users to significant legal uncertainty.

2. Financial Crime Exposure

We analyze the risk of financial crimes, including:

-

Money laundering

-

Fraudulent activity

-

Terrorism financing

-

Sanctions evasion

By assessing risk profiles based on FATF (Financial Action Task Force) evaluations and internal intelligence, we avoid markets where operating may facilitate or be exposed to illicit financial behavior.

3. Political and Economic Stability

Jurisdictions with ongoing conflict, political unrest, or economic instability pose heightened operational and user safety risks. Key risk factors we evaluate include:

-

Sanctioned or embargoed states

-

Government and institutional instability

-

Financial market volatility or banking restrictions

-

Weak rule of law or inadequate investor protections

🚫 List of Restricted Countries and Territories

Due to the factors outlined above, Yanance does not currently provide services to users located in or associated with the following jurisdictions:

Africa & Middle East

-

Afghanistan

-

Burundi

-

Central African Republic

-

Democratic Republic of Congo

-

Eritrea

-

Iran

-

Iraq

-

Lebanon

-

Libya

-

Mali

-

Mozambique

-

Somalia

-

South Sudan

-

Sudan

-

Syria

-

Tanzania

-

Yemen

Asia-Pacific & Oceania

-

Bhutan

-

Maldives

-

Myanmar

-

North Korea

-

Palau

-

Palestine

-

Timor-Leste

-

Tonga

-

Turkmenistan

-

Vanuatu

Europe & Surrounding Areas

-

Albania

-

Belarus

-

Cyprus

-

Kosovo

-

Montenegro

-

Russia

-

Ukraine

Americas & Caribbean

-

Bahamas

-

Barbados

-

Bermuda

-

Canada

-

Cayman Islands

-

Cuba

-

Haiti

-

Panama

-

Puerto Rico

-

Saint Lucia

-

Suriname

-

United States of America

-

US Minor Outlying Islands

-

US Virgin Islands

-

Venezuela

Overseas Territories and Regions

-

American Samoa

-

British Virgin Islands

-

Cape Verde

-

French Guiana

-

French Polynesia

-

Guadeloupe

-

Isle of Man

-

Jersey

-

Martinique

-

Réunion

-

Seychelles

-

Sint Maarten

-

Turks and Caicos Islands

⚠️ Please Note: This list is regularly reviewed and updated based on global regulatory developments. Restrictions may be expanded or lifted as jurisdictions evolve. We advise all users to check this list periodically.

🔐 Our Commitment to Responsible Access & User Safety

At Yanance, our top priority is the safety, security, and legal protection of our users. We know restrictions can be inconvenient for some, but they are vital for upholding the integrity of our platform and remaining in full compliance with international financial laws.

We maintain:

-

Robust AML/CFT (Combating the Financing of Terrorism) controls

-

Industry-leading compliance programs

-

Transparent policies based on global standards

-

Continuous legal and operational assessments

Our long-term vision is to make digital finance accessible to everyone — ethically, lawfully, and responsibly.

📞 Need Help or Have Questions?

If you have any questions about these jurisdictional restrictions or need help understanding our compliance policies, our Support Team is here to assist you.

-

📧 Contact us directly via our official support channel

-

🔎 Visit our Help Center for detailed articles and updates

-

🛡️ Learn more about our security and compliance commitments on our website

Share This Post

At Yanance, our mission is to build a secure, accessible, and innovative platform for cryptocurrency trading — spanning spot, futures, binary options, and peer-to-peer (P2P) markets. To achieve this, we strictly adhere to international legal and regulatory standards. This unwavering commitment to compliance means we must, in some cases, limit or prohibit services in specific countries or regions.

We understand that global access is crucial in the digital economy, but it must be balanced with regulatory obligations and the protection of our users, partners, and financial systems worldwide.

🔎 Our Risk-Based Compliance Framework

Yanance adopts a risk-based compliance model that guides our decisions on where and how we operate. This framework is designed to ensure that all our activities align with the legal, financial, and operational expectations of each jurisdiction.

1. Regulatory Environment

Before offering services in any region, we conduct an extensive review of its legal and regulatory framework. Key considerations include:

-

Whether cryptocurrency exchanges are recognized or regulated.

-

Local licensing requirements for digital asset service providers.

-

Anti-Money Laundering (AML) and Know Your Customer (KYC) standards.

-

Data protection and consumer protection laws.

We refrain from operating in jurisdictions where regulatory clarity is lacking or where compliance would expose us or our users to significant legal uncertainty.

2. Financial Crime Exposure

We analyze the risk of financial crimes, including:

-

Money laundering

-

Fraudulent activity

-

Terrorism financing

-

Sanctions evasion

By assessing risk profiles based on FATF (Financial Action Task Force) evaluations and internal intelligence, we avoid markets where operating may facilitate or be exposed to illicit financial behavior.

3. Political and Economic Stability

Jurisdictions with ongoing conflict, political unrest, or economic instability pose heightened operational and user safety risks. Key risk factors we evaluate include:

-

Sanctioned or embargoed states

-

Government and institutional instability

-

Financial market volatility or banking restrictions

-

Weak rule of law or inadequate investor protections

🚫 List of Restricted Countries and Territories

Due to the factors outlined above, Yanance does not currently provide services to users located in or associated with the following jurisdictions:

Africa & Middle East

-

Afghanistan

-

Burundi

-

Central African Republic

-

Democratic Republic of Congo

-

Eritrea

-

Iran

-

Iraq

-

Lebanon

-

Libya

-

Mali

-

Mozambique

-

Somalia

-

South Sudan

-

Sudan

-

Syria

-

Tanzania

-

Yemen

Asia-Pacific & Oceania

-

Bhutan

-

Maldives

-

Myanmar

-

North Korea

-

Palau

-

Palestine

-

Timor-Leste

-

Tonga

-

Turkmenistan

-

Vanuatu

Europe & Surrounding Areas

-

Albania

-

Belarus

-

Cyprus

-

Kosovo

-

Montenegro

-

Russia

-

Ukraine

Americas & Caribbean

-

Bahamas

-

Barbados

-

Bermuda

-

Canada

-

Cayman Islands

-

Cuba

-

Haiti

-

Panama

-

Puerto Rico

-

Saint Lucia

-

Suriname

-

United States of America

-

US Minor Outlying Islands

-

US Virgin Islands

-

Venezuela

Overseas Territories and Regions

-

American Samoa

-

British Virgin Islands

-

Cape Verde

-

French Guiana

-

French Polynesia

-

Guadeloupe

-

Isle of Man

-

Jersey

-

Martinique

-

Réunion

-

Seychelles

-

Sint Maarten

-

Turks and Caicos Islands

⚠️ Please Note: This list is regularly reviewed and updated based on global regulatory developments. Restrictions may be expanded or lifted as jurisdictions evolve. We advise all users to check this list periodically.

🔐 Our Commitment to Responsible Access & User Safety

At Yanance, our top priority is the safety, security, and legal protection of our users. We know restrictions can be inconvenient for some, but they are vital for upholding the integrity of our platform and remaining in full compliance with international financial laws.

We maintain:

-

Robust AML/CFT (Combating the Financing of Terrorism) controls

-

Industry-leading compliance programs

-

Transparent policies based on global standards

-

Continuous legal and operational assessments

Our long-term vision is to make digital finance accessible to everyone — ethically, lawfully, and responsibly.

📞 Need Help or Have Questions?

If you have any questions about these jurisdictional restrictions or need help understanding our compliance policies, our Support Team is here to assist you.

-

📧 Contact us directly via our official support channel

-

🔎 Visit our Help Center for detailed articles and updates

-

🛡️ Learn more about our security and compliance commitments on our website